Seeding the Future of Innovation

Welcome to IA, a seed-stage program for Tech start-ups in India and UAE that helps fast-track their growth & expand them globally.

Driving Transformation:

As a part of its strategic partnership, IA invests up to $500K of seed capital through its SEBI AIFs along with providing deep connects with Industries, company-building sessions, strategic mentorship, global expansion trips, perks & office spaces, hiring & building teams and support from a large community of exceptional founders.

Why IA

Defining IA is tricky. IA isn’t one company or business. Technically multiple legal entities or multiple business lines leverage the brand.

The initial vision for IA was to:

- a) find a better method of making startups successful

- b) create wealth for investors

- c) improve the entrepreneurial ecosystem in India

Over time, the vision has expanded to creating an inclusive ecosystem that can connect all the relevant stakeholders in the economy - the Academia, the Industry, the Government and of course, the Startups; and put this ecosystem on the world map.

Our thesis is simple. Invest early in undervalued, high potential companies. Invest where our capital, our network, business connections and knowledge can be a game changer.

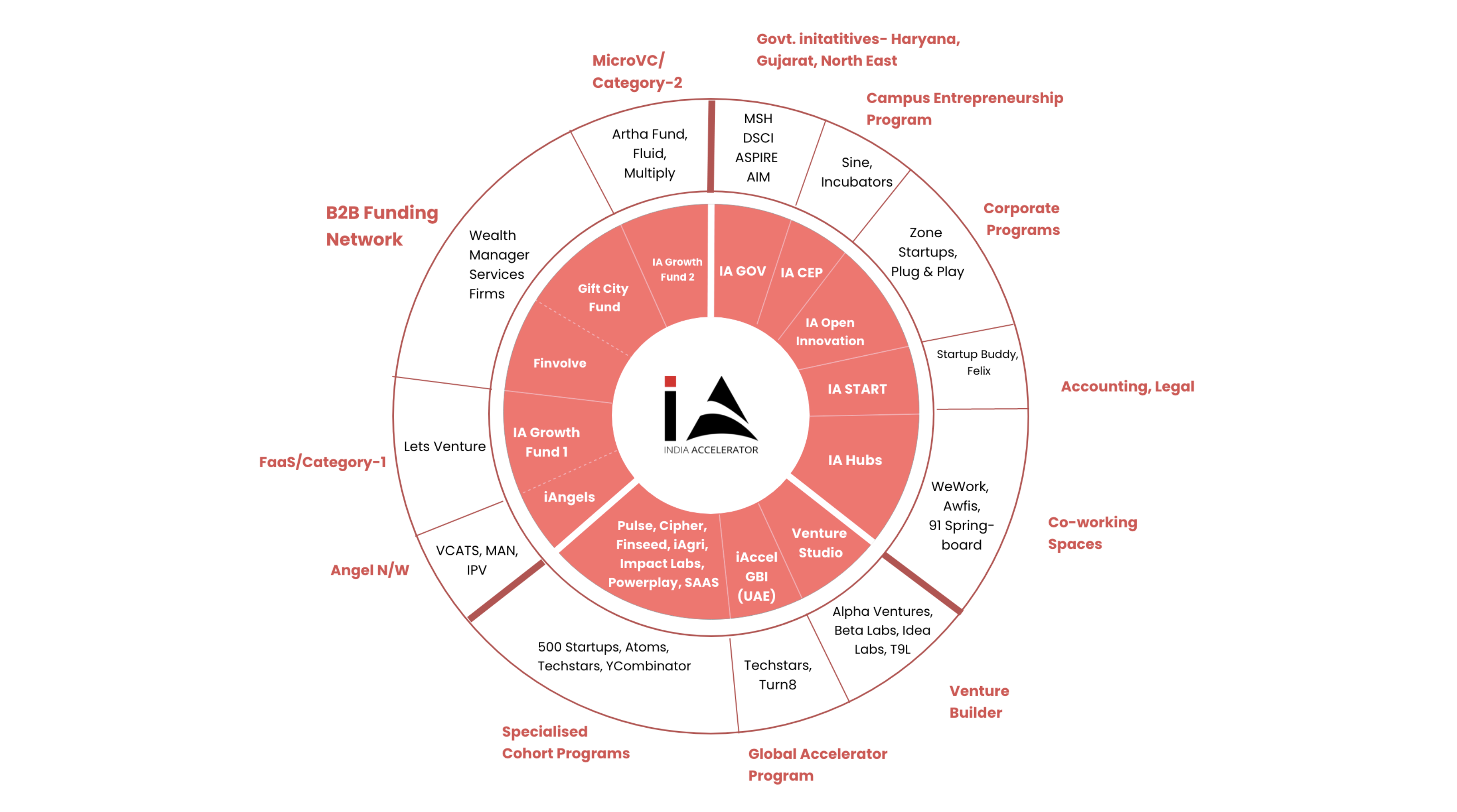

IA Stack: We are building the infrastructure of innovation and we are being innovative about it.

India Accelerator, awarded the Best Accelerator of the country in 2021, provides a dynamic and highly supportive ecosystem for startups in India. It offers a structured accelerator program that includes investment, business opportunities, mentorship, resources, and networking opportunities, which can significantly accelerate a startup's growth and increase its chances of success.

Accelerator Program

We recognize the critical factors that contribute to a company's growth, including access to capital, strategic partnerships, customer exposure, and mentor guidance.

That's why we developed our Accelerator Program, which offers curated mentorship, connections, and a comprehensive support system for growth-stage startups.

The program provides a range of benefits, including a deep understanding of revenue acquisition, strategic partnerships with venture capitalists and GAN partners, tailored mentorship for startup growth, and opportunities for financial investment.

By participating in this exclusive program, IA's startups gain the knowledge, tools, and connections necessary for their next stage of growth. The program focuses on accelerating startups' operations, fostering meaningful relationships with IA Partners, mentors, and investors, and is led by successful founders and corporate CXOs from the global community.

The program's primary objective is to define the possibilities for each business and establish a solid foundation for achieving those possibilities.

Success Stories

MOPP

IA D2C have not only helped strategize business plans but help multiple consumer centric brands to raise funds through StartUp India Seed Fund Scheme for the initial push to accelerate their business. MOPP has achieved an impressive growth rate, expanding by a remarkable factor of 7x. This achievement stands as a testament to the dedication and effectiveness of MOPP's team. The venture's success garnered attention on a larger stage when it appeared on the renowned TV show "Shark Tank," providing an opportunity to showcase its innovative concept to a wider audience.

A significant boost to MOPP's journey came in the form of funding from Amit Jain, the visionary founder of CarDekho. This investment not only validates MOPP's potential but also demonstrates the industry's belief in its vision and capabilities. Amit Jain's backing provides MOPP with a solid foundation to enhance its offerings and expand its reach.

BRAINWIRED

India Accelerator has helped Brainwired raise 40.2 K worth of funding from its syndicate of angel investors, as part of their Pre-Series A Capital fundraise which has been utilized to strengthen the product, double the revenue and expand the business. Brainwired has also been showcased at GITEX 2022 which helped them acquire potential clients and collaborate for overseas expansion. In addition to being selected as one among Top 25 agritech startups in India by GoI, Brainwired has also successfully raised money from Shark tank India!

LAWYERED

Lawyered – consumer focused Legal-Tech platform has secured USD 150k in the Pre-Series round of USD 1Mn from iAngels. This round of funding is led by India Accelerator iAngels – a well-recognized Angel Investor Network that has invested in Lawyered for the 3rd consecutive round.

STAGE

Stage is a dialect based, hyper-local OTT platform that provides content in dialects like Haryanvi, Rajasthani, etc. STAGE features content formats like long-duration web series, movies, short films, comedy, folk & much more.

They have co-invested with Blume ventures and other VC’s and were also featured on Shark Tank India Season 2 where they got a cheque in the same round.

JANITRI

Shark Tank India fame & IA's portfolio startup Janitri is an innovative healthcare technology brand that focuses on maternal and infant care. Their mission is to leverage technology and data to address critical challenges faced by women during pregnancy and childbirth, ultimately reducing maternal and infant mortality rates. After winning a deal at Shark tank India, they have secured $1.1 million in pre-Series A led by Angels-backed by India Accelerator.

ETHEREAL MACHINES PRIVATE LIMITED

Ethereal Machines is the leading manufacturer of 5-Axis CNC machines in India. They provide low-cost, high-performance, and easy-to-use CNC machines to cater to clients across various manufacturing sectors. The 5-Axis machining solves gaps in manufacturing, for industries extending from plastic to aerospace and automobile to healthcare. Their capabilities in terms of size, material, and finishing, and customer services give them an advantage over most in the market.

The startup has reached to a stage where it is ready for the next round of funding from one of the top VC’s of world.

MATTER MOTOR WORKS PRIVATE LIMITED

The technology company provides advanced energy storage solutions and innovative electric vehicle products. Notably, it has secured co-investments from notable entities including the Gauri Khan Family Trust and Capital 2B, underscoring its industry prominence. Adding to its achievements, the company proudly announces the appointment of Vicky Kaushal as its brand ambassador, signifying a shared commitment to a sustainable and empowered future.

Reap the Deep Domain Expertise

We empower startups in their transformation from good to great, serving as trailblazers with unparalleled

expertise across a spectrum of domains. From the forefront of technology and artificial intelligence to sustainable energy

and groundbreaking healthcare innovations, our team of industry veterans navigates startups through each phase of their journey.

Through bespoke mentorship, extensive networks, and avenues for securing funding, we provide entrepreneurs with the tools to flourish

and drive revolutions in diverse sectors. Collectively, we chart a course towards transformative progress, leaving a lasting imprint.

Our expertise is embodied in 11 specialized verticals.

Founders Speak

Brajendera Tomar

finayoFounder

“A startup funder journey can't be completed without an excellent accelerator platform. We found ours in IA. We gained a lot from the curated cohort program run by the India Accelerator. We thank IA for holding our hands ideation stage of their cohort program and providing us the fund to run our pilot project”

Capt Rahul Rai

Armour HeavyFounder

“IA offers startups an established ecosystem of professionals, allowing them to focus on their core offering while receiving comprehensive support. With access to mentors, advisors, and industry experts, startups can navigate challenges more effectively and seize growth opportunities. IA provides a range of services, including mentorship, business development, legal and financial guidance, and marketing expertise. By leveraging this support, startups can accelerate their progress and tap into valuable connections for partnerships and funding. Overall, IA empowers startups to thrive and achieve their goals.”

Lakshmi Das

ProphazeFounder

“Getting involved with IA was an exceptional experience that had a transformative impact on our business. With the aid of pre-seed investment from IA, we expanded our business operations to cover the entire northern region of India. This expansion also allowed us to bring on board talented interns who were part of our team. The mentorship we received was invaluable in refining our processes and strategies.

IA's contributions were instrumental in multiple areas, including fundraising, mentorship, business development, and enhancing our market visibility. As a result, Prophaze evolved from its initial stages into a pioneering force in the global application security sector.

We are determined to carry forward our vision of making Prophaze the ultimate solution for all application security needs, not just within India but on a global scale. Our journey with IA has been remarkable, and we eagerly anticipate the opportunity to bring our expertise and offerings to a worldwide audience.

”

Viresh Prashar

FruitFalFounder

“Fruitfal is thrilled to announce our partnership with India Accelerator. This collaboration marks a significant milestone in our journey towards transforming the fruit industry. India Accelerator's expertise, resources, and network will undoubtedly propel us forward as we revolutionize how fruits are sourced, distributed, and enjoyed across Bharat.

We are confident that this partnership will open doors to invaluable opportunities for growth, innovation, and market expansion. The collective knowledge and support offered by India Accelerator will enable us to enhance our offerings, reach a wider audience, and create a lasting impact in the agricultural and tech sectors.

We are excited to embark on this journey alongside India Accelerator and look forward to achieving remarkable milestones together. With their backing, Fruitfal is poised to reshape the fruit supply chain and make fresh, nutritious produce accessible to all.

Thank you, India Accelerator, for believing in our vision and for this remarkable opportunity.

”

Karthik Venkataraman

SublimisFounder

“Sublimis has been associated with India Accelerator for a year now and not only has IA Team help Sublimis to plan the growth strategy but are also helping us in getting a lot of visibility across their Business Network Regions both in India & Outside of India. We value their connections, recommendations and all efforts to ensure the Sublimis is on the right path towards growth and increasing Stake Holder value. There has been focussed efforts to help Sublimis with Business Development Opportunities in India & Abroad. IA is also helping Sublimis in the Fund Raising Process. Sublimis Team would like to express their gratitude to the team of IA and we look forward for more synergies and growing Sublimis in the global Road Map.”

Rehman

NoraaFounder

“Noraa's association with India Accelerator has been a strategic advantage. Their comprehensive support, including funding guidance and networking opportunities, has been a catalyst in our startup's progress. With their backing, we've navigated the challenges of entrepreneurship with confidence.”

Akashjyoti Das

FoodioTechFounder

“As the founder of FoodioTech (Har Restaurant ka Right Hand) I can confidently say that our journey wouldn't have been the same without their unwavering guidance and mentorship. India Accelerator not only provided us with crucial exposure and valuable connections within the startup ecosystem, but also gave us a reality check that helped us refine our business model.

Their involvement didn't stop there – they played a pivotal role in securing our initial investment, raising the first investment cheque through the Startup India initiative. Abhay Chawla, Co-founder of IA is our dedicated supporter since day one, has been a constant source of encouragement and insights, guiding us through the challenges of the entrepreneurial landscape.

The entire India Accelerator team has been instrumental in propelling our business to new heights. Their strategic expertise, hands-on approach, and wealth of knowledge have been crucial as we navigate the complexities of scaling our startup. We are truly grateful for their continuous support and are excited to see what the future holds, thanks to the foundation they've helped us build for FoodioTech

”

Ramesh Joshi

FundCorpsFounder

“It feels great to have IA Impact Labs as a partner for FundCorps in scaling the work we have been doing. The team is very helpful in responding to the needs, understanding our product in detail, and helping with the network. Assigning a lead mentor is one of the beautiful things done by IA as we as a company get to have a third eye perspective to what we are building, where we are headed, and what we are trying to achieve”

A True Global Accelerator

DUBAI

SRILANKA

INDIA

India’s First Mentor driven Co-Working Space

Welcome to India Accelerator, where innovation meets collaboration in our premier coworking spaces. With a strong presence across Gurugram, Noida, Ahmedabad, and Pune, our thoughtfully designed work environments offer more than 200 seating areas in each city.

Join a vibrant community of entrepreneurs, startups, and businesses to access not just workspaces, bu

Know More

In the News/Blogs

Denta Mitra revenue grows 200% in FY 22, reaching INR 30 Million

https://startupstorymedia.com/denta-mitra-revenue-grows-200-in-fy-22-reaching-inr-30-million-marking-a-profitable-milestone-for-the-company/

India Accelerator partners with Z Nation Lab, expands to Silicon Valley

https://economictimes.indiatimes.com/small-biz/sme-sector/india-accelerator-partners-with-z-nation-lab-expands-to-silicon-valley/articleshow/100623622.cms?from=mdr

Armour Heavy performance wear closes seed round led by India Accelerator

https://economictimes.indiatimes.com/small-biz/sme-sector/armour-heavy-performance-wear-closes-seed-round-led-by-india-accelerator/articleshow/99431269.cms

iAngels aims to invest in 100 startups this year

https://www.financialexpress.com/industry/new-opportunities-iangels-aims-to-invest-in-100-startups-this-year/3016768/

Do you have an idea and want to grow your startup?

Let's Talk